In a potential groundbreaking move, SpaceX, the renowned aerospace company spearheaded by Elon Musk, is contemplating an initial public offering (IPO) as early as next year. This consideration aims to gather substantial funds to bolster ambitious projects including missions to the Moon and Mars, as well as the establishment of orbital data centers. The announcement, made by SpaceX’s Chief Financial Officer Bret Johnsen, has stirred significant interest and speculation in the financial and space industries alike.

The news emerged from an internal communication sent to SpaceX employees on December 12th, where Johnsen elaborated on the company’s plans. Although he emphasized that the decision regarding the IPO and its timing remains highly uncertain, the mere possibility of such a move has piqued widespread curiosity. SpaceX, recognized as one of the most valuable private enterprises globally, could leverage an IPO to generate tens of billions of dollars. This influx of capital would support the company’s lofty goals in space transportation and development of related services.

Johnsen’s message highlighted the potential benefits of a public offering, suggesting that it could significantly augment the flight rate of Starship, SpaceX’s next-generation spacecraft. The funds raised could also facilitate the deployment of artificial intelligence (AI) data centers in space, the construction of a Moonbase Alpha, and the launch of both uncrewed and crewed missions to Mars.

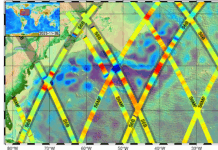

The speculation regarding the establishment of orbital data centers is particularly noteworthy. Such centers are envisioned to cater to the burgeoning demand for AI computing capabilities. Elon Musk has shown a keen interest in this area, envisioning a future where SpaceX’s Starlink broadband constellation could be leveraged to support these operations.

In a recent social media post, Musk elaborated on the potential advantages of satellites equipped with localized AI computing power. He suggested that such satellites, which would transmit only the results back to Earth from a low-latency, sun-synchronous orbit, could represent the most cost-effective method to generate AI bitstreams within the next three years. Furthermore, Musk asserted that this approach would allow for rapid scaling within four years, circumventing the increasing scarcity of easy sources of electrical power on Earth.

Musk also confirmed, in response to an analysis linking SpaceX’s IPO interest to the orbital data center plans, that such speculation is indeed accurate. Historically, Musk and other SpaceX executives have maintained that the company would not go public until it achieved regular flights to Mars. This sentiment was echoed by SpaceX President Gwynne Shotwell in a 2018 CNBC interview, where she stated that regular Mars flights would be a prerequisite for considering an IPO.

To date, SpaceX has postponed an IPO by offering periodic tender offers. These offers enable employees and other shareholders to sell shares on secondary markets, thus providing liquidity. Johnsen’s recent message about a potential IPO accompanied the announcement of the latest tender offer, which set the share price at $421. This valuation places SpaceX’s worth at approximately $800 billion, a significant increase from the previous valuation.

Andrew Chanin, co-founder and chief executive of ProcureAM, which manages the Procure Space ETF—a fund focusing on space industry companies—provided additional context on the IPO speculation. He suggested that the buzz surrounding orbital data centers might be one factor prompting SpaceX to consider going public. Chanin noted that SpaceX’s existing technological advancements position it well to capitalize on emerging space-related opportunities.

Should SpaceX decide to go public, Chanin anticipates robust demand for its stock. He noted that both retail and institutional investors have long expressed interest in gaining access to SpaceX shares. Chanin’s fund, while not directly owning SpaceX stock, has indirect exposure through EchoStar. In September, EchoStar announced a deal to sell spectrum to SpaceX for $17 billion in cash and stock. This transaction has significantly boosted EchoStar’s share price, which has surged by 54% over the past month, partly due to the increasing value of the SpaceX stock it is set to receive.

The rising value of this deal could potentially benefit other companies within the sector. Louie DiPalma, from investment bank William Blair, pointed this out in a research note dated December 8th. He identified companies like Globalstar, Iridium, and Viasat, which hold global satellite spectrum allocations, as potential beneficiaries whose asset values could appreciate.

An IPO by SpaceX could also have far-reaching implications for the broader space sector. According to Chanin, it could provide SpaceX with additional capital for acquisitions and create new opportunities in adjacent markets. He highlighted that while SpaceX might not be interested in developing certain technologies, this could pave the way for other space companies to step in and fill those gaps.

Despite the excitement surrounding the potential IPO, Johnsen cautioned employees about the uncertainties involved. He reiterated that the occurrence, timing, and valuation of any such offering remain unpredictable.

SpaceX’s potential IPO represents more than just a financial maneuver; it symbolizes the evolving landscape of space exploration and technology. The company’s endeavors, from lunar bases to Mars missions and AI-driven satellites, underscore the transformative potential of space as the next frontier for human innovation. As SpaceX continues to push boundaries, the prospect of going public could serve as both a catalyst and a testament to its visionary goals.

For more Information, Refer to this article.