Learn what is Tez and how is it different from other e-wallets and payment apps!!

Note: On Aug 28th, Google rebranded its payment app Google Tez to Google Pay.

On Sep 18, 2017, Google launched its new Payment and money transfer App-Tez, specifically made for India. Tez, is an Urdu word which means fast, and no doubt the Google’s Tez app is very fast in transferring or sending money within the country. As Google launched this App exclusively for Indians, so it also supports other regional languages like Hindi Bengali, Gujarati, Kannada, Marathi, Tamil, and Telugu in addition to English. The App has become increasingly popular these days and people are doing as much transaction as possible in the hope of getting rewarded with cashback from Google. Google is running various cashback and lucky draw offers for its Tez users to encourage them to do more transactions and attract more users.

|

| Google Tez Rewards for sending and receiving money |

With the launch of Tez app, Google joins India’s crowded mobile payment market and is set to shake up the fintech segment which is currently ruled by Softbank-backed Paytm and by the likes of BHIM. Google’s entry into the digital mobile payments is definitely going to benefit the users and help democratize digital payments segments.

As reported in different newspaper articles, the app was downloaded by five million Android users just within the 24 hours of ‘Tez’ being launched. Google Tez is also luring the Android and iOS users by offering a total of ₹9000/- per year as reward. And the best thing about the reward is that it comes in the form of cash, directly into your bank account and there is no discount code or promo code that you need to remember as its applied automatically and you get rewarded in most of the transactions. With this new promotional approach and a huge Android users base, I am sure Google is going to make most of it.

What is Google Tez?

Unlike other e-wallets such as Paytm, MobiKwik, or Freecharge, Tez is neither a mobile wallet nor a Payments Bank or a modified version of Android Pay. It seems like a mixed modified version of PayPal and Android Pay. In Tez, user is just required to link his/her bank account to pay for items in physical or online stores and to receive money directly into the bank account. So the money is never loaded to any wallet or such form neither is temporarily held by Tez but money is moved from one bank account to other instantaneously. Tez works on government’s backed UPI and BHIM app interface and its just like a platform that connects your bank to UPI and provides you with a UPI address to send and receive money. Gone are those days when we used to share the long bank A/C no., IFSC code, Account holder’s name and name of the bank in order to send or receive money and now with the advent of UPI, sending or receiving money has become much easier as it only needs the virtual Payment Address (VPA) or the UPI ID which looks like yourname@yourbankname. For more information on UPI and BHIM app you can read the previous post – What is UPI payment method and BHIM app?

In order to signup with Tez- A user must have an Indian bank account, and a local phone number registered with the same bank account. Google has partnered with Axis, HDFC, ICICI and SBI bank to facilitate the payments processing across over 55 UPI-enabled banks. Tez also introduces a new feature that runs on a Google’s proprietary technology called Audio QR (Patent filed by Google) which allows one to send money to a nearby Tez users without sharing any personal and financial information which can be a best option to make payment to a Chaiwaala, Cab driver or a Rikshaw driver.

It is designed in a chat like interface which is easy to use. With this app you don’t need to share your personal information or bank details with other party. Now you can pay your taxi fare without sharing your details, just the UPI id is enough. Some big names like Dish TV, Uber, Red Bus, PVR, Domino’s and Jet Airways has already included Tez as a payment option and of course, because it uses UPI, you can pay almost any merchant who supports payment through UPI.

Google is also planning to partner with companies like Micromax, Nokia, Lava, Xolo and Panasonic for pre-installing the Google Tez app on all upcoming smartphones from these brands.

How does Google Tez work?

Tez works on UPI based payment method. User has to link his/her bank account after signing up and then set a UPI pin for carrying out the secure transaction. Using Tez, you can send money to any Tez user’s phone number, any UPI ID and any bank account using Account number and IFSC code. Money is instantly debited from your linked bank account and credited into the recipients account number. Another option is by using the camera to scan QR and the App’s Cash Mode which is built using Google’s proprietary AQR (Audio QR) technology which finds other Tez users in proximity and the money can be transferred without sharing Mobile number, Email ID or Bank account number. Tez is also safe and secured by both Google App PIN and UPI Pin.

How to get started with Tez?

- Using Tez app to send or receive money is very simple, Just download the Tez App from Google Play Store or the iOS App Store.

- Set your Google Pin or Screenlock for the App security.

- Add / Link your bank account and set your UPI pin while adding the account.

- Add mobile number registered with your bank account.

- And start sending or receiving money with your Tez UPI id which may look like your gmail userid@okicici or userid@okhdfcbank or youruserid@okaxis.

The best part is that you get instant rewards of ₹51/- as pure cash into your linked bank account when you are referred by someone and you make the first transaction from Google’s Tez app (Even a transfer of ₹1/-). You can earn further by referring more friends and and family members when they install Tez from your referral link and they make a minimum transaction of ₹1/-. If you are new and never heard about it then you can use the below link to download Tez and send money to someone from your contacts or add money to your Paytm wallet using the UPI ID created by Tez and both of us will be rewarded by ₹51/-.

Remember to use the referral code (X6119)- before your first transaction. to receive the ₹51 instant bonus.

Getting started

1. Download Tez from Google Play Store or the iOS App Store.

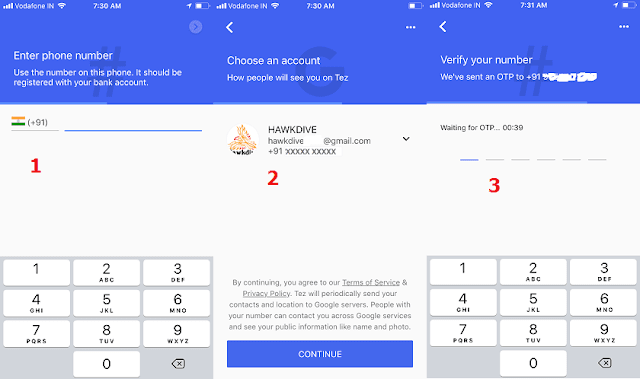

2. Open the App and select the language you want to use. Verify the Phone number registered with your Bank.

|

| Setting Up Tez – A payment app by Google |

3. Select the Google account you want to associate with Tez app.

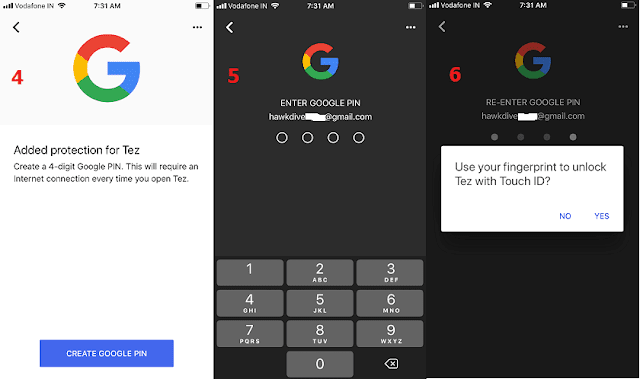

4. Create a 4-digit Google Pin or choose to use your Finger Print / screen lock for App security.

| |

|

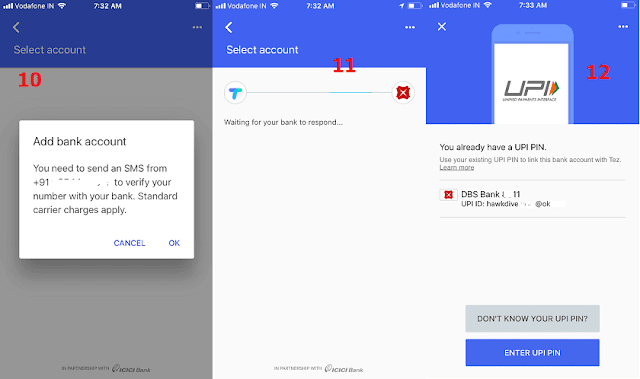

5. Now select Add Bank Account from Top and choose your Bank name having the same number registered with your account.

6. The app will send an SMS to NPCI( National Payments Corporation of India) to find the linked bank account and display the account automatically.

| |

|

7. Select the account name and create a new UPI pin or select already have the UPI pin if you already created it using your banks specific mobile banking app.

8. If you are creating the UPI Pin for the first time you will be asked to enter the last 6-digit of your ATM/ debit card number and expiration date. Once the UPI pin is created your account will be added to Tez and you can use the app to send and receive money.

|

| Setting Up Tez – A payment app by Google |

|

| Setting Up Tez – A payment app by Google |

How Google Tez is different from other mobile wallets ?

As I already mentioned in previous paragraph that the Google Tez app is neither an e-wallet nor a Payments Bank or a modified version of Android pay. It’s just a platform that connects you Bank account with UPI or BHIM interface and allows the user to send or receive money to and from the linked bank account. Your money remains with the bank and so you do not need to deposit the money to the app wallet or interface, prior to make any transaction. Just choose to pay and verify the UPI Pin to complete any transaction.

There is no charge on any types of transactions done through Tez app while banks and other mobile wallet apps charge a commission on NEFT, IMPS and RTGS transaction and also limit the amount you can send at one time. However, Using Tez you can transfer the maximum amount allowed by UPI methods as set and specified by the government. As of writing the maximum allowed transfer through UPI is ₹1,00,000 ($1,561) on daily transfers and Tez will let you do the same. Most of the bank apps only allow 20 transfers in a day but there is no such limits on Tez.

As already mentioned, its unique AQR technology allows you to pay or send money without sharing any personal or financial information. Simply select cash mode and put the app on send mode and the receiver will put his app on receive mode. Tap on the name from the list of nearby detected Tez users and send money to the selected user. It’s that simple like transferring movies or music using SHAREiT. It’s designed as a lite app with smaller size and can run even on a slow internet connections.

Benefits of using this TEZ app:

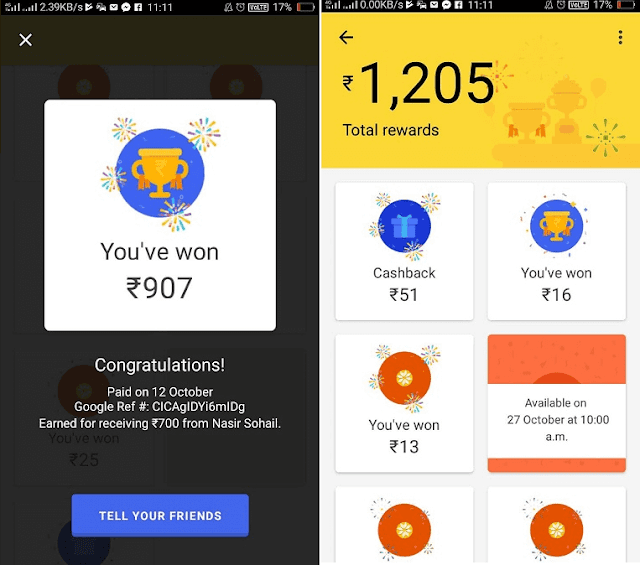

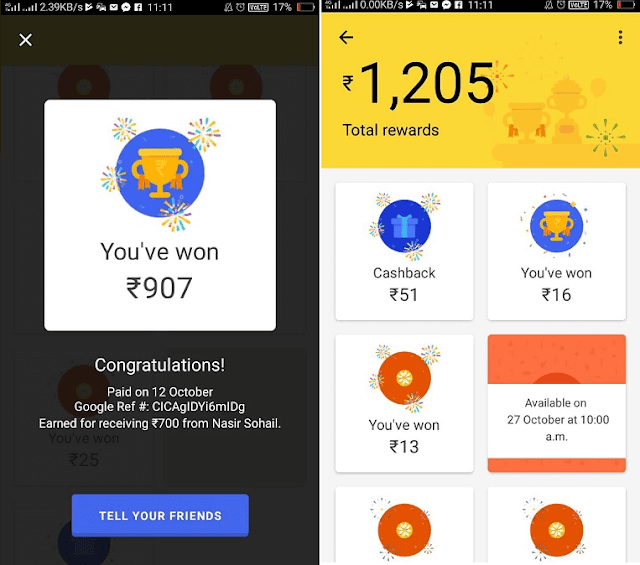

As an introductory and promotional offer Google is rewarding both referral and referee with a cashback of ₹51/- direct into their linked bank account. Apart from that, every transaction of amount ₹50 or more is rewarded with a scratch card of upto ₹1000/-. You won’t believe that both you and the other party whom you are sending or transferring money to can earn extra cash while sending or receiving money through Tez. I did not believe that either when my friend told me that he was lucky to get rewarded with ₹3000/- so far by doing multiple transaction using Tez. I downloaded the app and started sending payments to people whom I work with and luckily I got additional ₹1200 in my bank account from referral and scratch card bonus within 3 days. Here are the screenshots of the rewards.

|

| Tez – Cashback and Rewards |

So download Tez app and start using it to become Tez as I am sure in near future or withing 2-3 months from now every one will have a Tez ID just like a WhatsApp and Facebook account and thus sending or receiving money will become much easier. You can earn a maximum of ₹9000/- in a financial year by referring someone and also you can be luckier to get rewarded with ₹1 Lakh in a week if you make transaction of ₹500 or more as per Google Tez. All these rewards and cash that you win gets transferred directly to your bank account.

How to Send money using Tez?

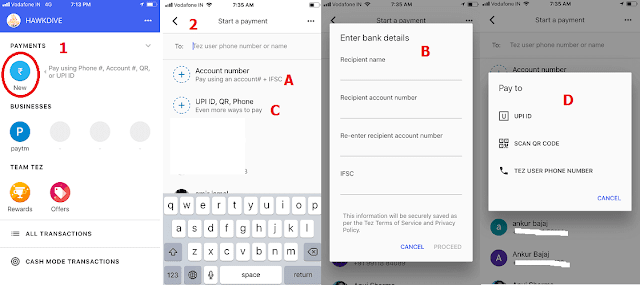

- Simply select the option new and type the name of the recipient or Tap Account number to send money using Bank A/C and IFSC code. Select UPI ID, QR or Phone option to send money using UPI or Phone number.

- Type the UPI ID or Phone number of the recipient, Tez will check if the information is correct and shows you the name of the recipient if its correct.

- Type the amount > select continue and then verify the UPI Pin to send money.

- Similarly you can also request money from someone by simply clicking on the request button instead of send.

|

| How to Send money using Tez? |

How secure is Tez ?

Well, being an app from Google itself certifies it as the most secure App. Though it has UPI PIN, Google PIN and Tez Shield which create multiple layer of security as told by Google India. Tez Shield protects from possible spam, fraud or hacking. If there is any concern or the transaction fails you can contact Tez support team right from within the app.

To contact Tez support team tap on your name on top left and select “Help & feedback” under Information section. Select to request a callback or chat with a representative or send a feedback.

Some drawbacks of Google Tez:

Though the app is much faster, reliable and secure but some loose points are there which can make you think to use this app or not. If you are already using other UPI app like PhonePe and Chillr then you may not want to switch to Tez as you can pay your utility bill, insurance payments, store payments using QR code or you can do mobile recharges right within the app easily which you can’t in Tez at least for now, for e-payments you still have to use other wallets like Paytm; PhonePe, Mobikwik while Google Tez is simply for basic money transfer.

Unlike other e-wallets such as Paytm, you cannot add or borrow money from credit card or debit card into your wallet.

That was all about the new payment and money transfer app from Google which is really fast and because of UPI featuring app it is easy to send or receive money just by typing the UPI ID or looking through your contacts. I have been using the Tez for almost a month now and really love it. Share your experience using Tez with us if there is something interesting or problematic do let us know here in the comment section.

You may also like to read: What is Paytm’s Payments Bank in India?

![The Apex Legends Digital Issue Is Now Live! Apex Legends - Change Audio Language Without Changing Text [Guide]](https://www.hawkdive.com/media/5-Basic-Tips-To-Get-Better-On-Apex-Legends-1-218x150.jpg)